8 Ways You Can Stay Financially Fit After Your Divorce

- This blog contains affiliate links, which we may receive a commission for purchases. The decision is yours, whether or not you decide to buy.

When you’re an optimist, life has a funny way of looking after you.” - Simon Sinek

Hi there! The reason for starting this article with an optimistic quote is after your divorce what you need most is mental strength. The mental strength will help you to be an optimistic person in your life in the post-divorce period. The primary point to discuss in the article is you can only earn the mental strength within you when you will be financially stable to cope with your divorce.

So, here is a list of what you can expect as a change in this post-divorce phase of your life

-

After the altered and reduced income, the second change you may witness is regarding your house. Usually, after the divorce, one partner stays in the house and purchases the other partner’s share by cash-out refinance, or through a property settlement note.

So, the entire mortgage loan repayment falls on the single partner who decides to live in the house. It may create a burden on your finances in the changed scenario.

-

A. Your monthly and annual income may drop in the post-divorce phase of your life. In the pre-divorce period of your life, when your and your husband’s income was in joint, then you might have spent a lavish life.

With the changed situation currently, everything is dependent on your income. So, you can expect a financial change in the post-divorce phase of your life.

- In a divorce, it is generally seen that one partner takes care of everything related to finance and the other partner overlooks it and does not take care of the family’s finances seriously. This matter is generally observed with women especially. But in the post-divorce phase, along with other changes, you have to adopt this new habit too.

Now, you have to take care of your personal property, liquid assets, retirement assets, real estate, life insurance; primarily everything related to personal finance. So, when you are going through the post-divorce phase; you may expect these drastic changes in your life. So, you have to be more cautious along with taking more care of your personal finance.

Now, take a look at the 8 ways to stay financially stable and fit in the after-divorce phase of your life

Experts say that change is inevitable in our life. So, you don’t need to lament or have any repercussions in your mind that now you are divorced. The divorce may bring the independent-self from the inside of you. You may enjoy your new life of being financially stable.

How to stay financially stable and fit in the post-divorce phase of your life:|

1. Review your budget in the post-divorce phase:

The divorce is going to change your previous financial situation. Now, you have to bring changes to your new life. The budget is the first step where you need to bring changes immediately. You may face serious financial hazards if you like to continue your old spending habit. Now, you are the sole person who has to bear all the spending on your household. So, you have to review your budget in the post-divorce phase first.

2. Create a concrete plan to deal with your debts:

Be it secured debt like a mortgage, or unsecured debt like credit card debts; the loan payment is always a burden. Especially, when you are divorced then the pressure of repaying the debts will fall on your shoulder. So, a better strategy is to create a concrete plan to deal with your debts.

For mortgage, you can choose the mortgage-refinance option, and for credit card debts, you may choose balance transfer card, debt management plan, debt settlement, etc. these various options.

You should not accept any payday loan. A payday loan is a trap where you will accept the quick money in an emergency; later you will lament the high-interest rate. However, if you are already entrapped by a payday lender, you can ask the experts regarding how to reduce payday loan debt.

3. There are plenty of side-hustles to increase your income:

In the post-divorce phase, what you need most is a few extra income avenues. The side-hustles may help you to increase your income. You can choose any side-hustle or weekend income as per your qualification. At the time of divorce, a side hustle may help you to earn something extra.

4. Start developing your credit history and good credit score:

At the time of marriage, if you don’t have any credit card or loan in your name then you may face problems in the future while you will go to apply for a credit card or any loan. So, the better option for you is to apply for a secure credit card and make small purchases by using the credit card. If you make regular payments then it will help you to build a good credit score. When you are not dependent on anybody, you must build a good credit score on your own.

5. Time to change your tax- paying mode:

You cannot file taxes as married anymore. So, you need to change your tax situation. Now, you have to file your taxes as single so you may talk with the tax authority now and change the tax-situation.

Otherwise, you may have to pay a big tax bill.

6. Time to change your health insurance option:

Your ex-partner’s health insurance coverage is no longer going to cover you. So, it is time to change your health insurance options. You should take your time and change your previous health insurance option. Your new health insurance must cover you and your kids. It is one of the important points related to financial stability.

7. Along with the revised budget, modify your financial plan also:

You may have to think about a modified-future as you are divorced now. The word ‘modified-future’ may sound harsh but this is the reality for you now. So, the revised budget which is helping you to sustain yourself in the post-divorced phase, you may have to modify your financial plans also for now. You can now emphasize creating an ‘Emergency Fund’, ‘good retirement and investment plans’ etc as the entire family is dependent on you.

8. You can consult a financial professional:

Accepting professional assistance can be helpful to you to create a modified-financial plan in the post-divorce phase when the entire family may be dependent on you. You can consult a Financial Planner immediately after your divorce to take a grip on your personal finance like budgeting, tax problems, etc. These are the 8 rules you should follow to stay financially fit and stable in the post-divorce period.

Final words

Coping with the post-divorce phase is hard. You need inner strength to face the storm from which you are going through now. These 8 points, written above, may help you to stay financially stable and fit after your divorce. In the end, maybe there was not everything bad about divorce for you.

Author Bio: Catherine Burke is a financial writer for online payday loan consolidation. She provides information on successful cash loans and payday loan consolidation to help people get over a difficult patch.

PHOTO CREDIT: BR: PINTEREST,COM, LINKEDIN SALES NAVIGATOR, PAIGE CODY, GRANIT ARCHITECTS

You may also like

Books

Buy now from Amazon

Podcast

Sara Davison has created Heartbreak to Happiness podcast. If you’re hurting or struggling with a break up and you’re feeling shocked, betrayed, devastated, and alone then this podcast is for you. Now is the best time to minimize your own suffering in this process by listening in on the most empowering and best relationship advice available.

Articles

- Getting Back With Your Ex: The Pros And Cons

- Busyness And Relationship Breakdown

- Divorce And Online Dating

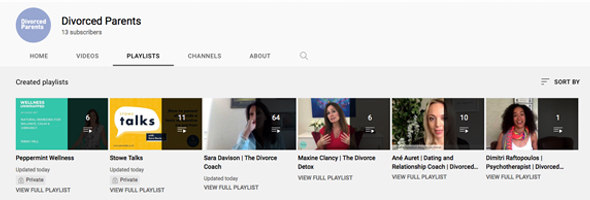

Videos

Practical advice and tips from professionals on what to do with issues and challenges around divorce from parenting to finance.

Events

Practical tips & advice designed to help people going through divorce, whether online or in person.

Useful links

Here's a selection of organistaioins from parenting to finance to help you with your divorce.

Coaching | Counselling professionals

Related Posts

-

Financial Planning After Separation: Budgeting for Two Households

-

Child Maintenance & Financial Support for UK Parents

-

What Is A Clean Break Order In UK Divorce? FAQs On Financial Settlements

-

Financial Management Strategies for Stepfamilies

-

Are Private Financial Dispute Resolution Hearings Necessary For Divorcing Couples In These Uncertain Times?

.jpg)