Framing A Financial Plan After Divorce

- This blog contains affiliate links, which we may receive a commission for purchases. The decision is yours, whether or not you decide to buy.

For some divorce is a massive release. For others it is a painful blow – but for most, it leaves the family finances in turmoil. My mother’s divorce left her feeling vulnerable and skint.

My father, well, he probably felt much the same. They were the main players in an apocalyptic battle where the whole family were left wounded. Luckily, my Mum knew that this was the time to make a financial plan.

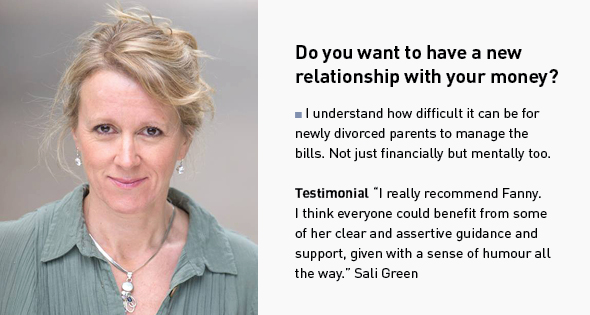

- Fanny Snaith full profile

- More finance professionals

Getting a handle on the family finances NOW would make sure that we made the best of what we had. She was determined that all leaky buckets were plugged - not wasting any of the little we had.

Quite quickly, Mum became aware of every single financial detail of her new scary, and sometimes lonely, life with her children.

She found the courage to address her finances head on. This helped build her shattered self-esteem which in turn boosted her confidence. Follow these tips to help you get back on your feet and in control:

Ask for help!

Divorce is emotional. If you feel like you’re overwhelmed by the sheer amount of paperwork or confused with what is on it, then ask a friend or seek professional help.** Life is complicated enough right now – make it simpler by keeping a financial notebook.

Page 1 is the index. Number the other pages and use a fresh page for each bank account and credit card you have.

Use page 1 to index them. On each relevant page write down the interest rate, payment due date any phone calls you make to that provider etc.

You can also use this book to list phone contracts and other utilities if it helps. Keeping this information in one place is invaluable. Remember not to list all the information someone will need to get access to the account here though – keep passwords separate! ·

Buy yourself a notebook purely for your finances.

Life is complicated enough right now – make it simpler by keeping a financial notebook. Page 1 is the index. Number the other pages and use a fresh page for each bank account and credit card you have. Use page 1 to index them.

On each relevant page write down the interest rate, payment due date any phone calls you make to that provider etc. You can also use this book to list phone contracts and other utilities if it helps.

Keeping this information in one place is invaluable. Remember not to list all the information someone will need to get access to the account here though – keep passwords separate! ·

Get hold of a folder and some dividers

Start filing paperwork. Don’t worry about filing it perfectly – just get it in the folder for now. Sorting can come later.

Build a list of all the things that involve money

Mortgage/rent, bank accounts, saving accounts, credit cards, store cards, phone contracts, insurances for the home, health/pet insurance, utility bills etc.

Then go through them one by one becoming aware of what they are and how much they cost.

Question Everything

With each account or contract you look at, ask yourself

What is this?

Do I need this?

What are its benefits?

Can I get it cheaper?

Don’t be afraid to call each provider and ask for a better deal. Scrutinise every direct debit and standing order on all bank accounts and make sure they are up to date and valid – if not delete them.

Build a family budget

List all outgoings and incomings. Become aware of what bills are due and when. Would it help to change a direct debit date to suit when income comes in? Yes? – then call the provider and ask.

Avoid financial shocks when they are due

Start planning for larger bills coming up later in the year – holidays, car tax etc. and set aside cash into a separate savings account.

Consider downsizing your home

If your family home payments are high maybe a move is wise? Moving can be an emotional decision but if the budget is tight, moving to a less expensive home or renting may be a good option to consider.

If you have a mortgage and it is being paid on an interest only basis, is the debt covered with an insurance to pay the loan back when the mortgage period is up?

If on a repayment mortgage – can you afford the payments or even, consider overpaying? If you feel that the only option is to move to an interest only mortgage, then make sure you have insurance to cover the loan – this is vital.

Plan your career

Either going back into the workforce or finding higher paid employment may seem daunting. Increasing income will help your financial plan hugely. Consider re-training or up-skilling.

Maybe a college course or even take a course on-line. Think about any joint insurance or pension you may have had.

Are they still valid?

Do I need extra cover now?

Has your partner’s pension been divided correctly?

Contact the Money Advice Service for help on dividing pensions. Remember to write a new will too. If finances are new to you - be brave.

Avoid isolating yourself financially through embarrassment, confusion, feeling depressed or anxiety. There are many, many people out there in the same situation who will be happy to show you the way.

Working through your finances, getting to know your numbers inside out, is so empowering and this is just what you need to help protect you and your family’s financial future.

Written by Fanny Snaith Financial Freedom Fighter 01242 584 252 www.fffighter.com

** Fanny Snaith – The Financial Freedom Fighter When all financial matters seem overwhelming at a time when all else seems to be crumbling, then consider using a professional like myself to help. 99% of my clients save at least double my fee during the first couple of sessions.

I will help build a plan for you, going through each step with you. Your ability and patience to attack these issues will determine the service you require. Each client is different – dealing with things in different ways.

I am not an accountant nor a financial adviser so will not be selling you any financial products. I cannot give you any professional financial advice – just my balanced opinion.

I have many years’ experience working with money including, but by no means limited to, running a plumbing and heating firm with my husband Neil for the last 17 years. Call me for a 30 min clarity session – absolutely free of charge and obligation.

PHOTO CREDIT: FREEIMAGESLIVE

You may also like

Books

Buy now from Amazon

- The Co-Parenting Handbook

- Fair Share: How the divorce courts in England & Wales deal with your money

- The Book You Wish Your Parents Had Read THE #1 SUNDAY TIMES BESTSELLER

Podcast

This personal finance podcast is for women, including female entrepreneurs to learn personal finance, money mindset & practical money management tips to be financially confident. To get in control of money, to budget, gain financial confidence, learn how to invest, save money & manage money mindset and behaviours. Hosted by a multi- award winning qualified financial planner and financial coach.

- Listen to the In Her Financial Shoes Podcast

- Catherine Morgan full profile

- More professional podcasts

Articles

- 8 Ways You Can Stay Financially Fit After Your Divorce

- Five Things To Let Go Of After Divorce

- Buying A Home Post Divorce Part 1

Videos

Practical advice and tips from professionals on what to do with issues and challenges around divorce from parenting to finance.

Events

Practical tips & advice designed to help people going through divorce, whether online or in person.

Useful links

Here's a selection of organistaioins from parenting to finance to help you with your divorce.

Finance professionals

.jpg)

.jpg)